Back

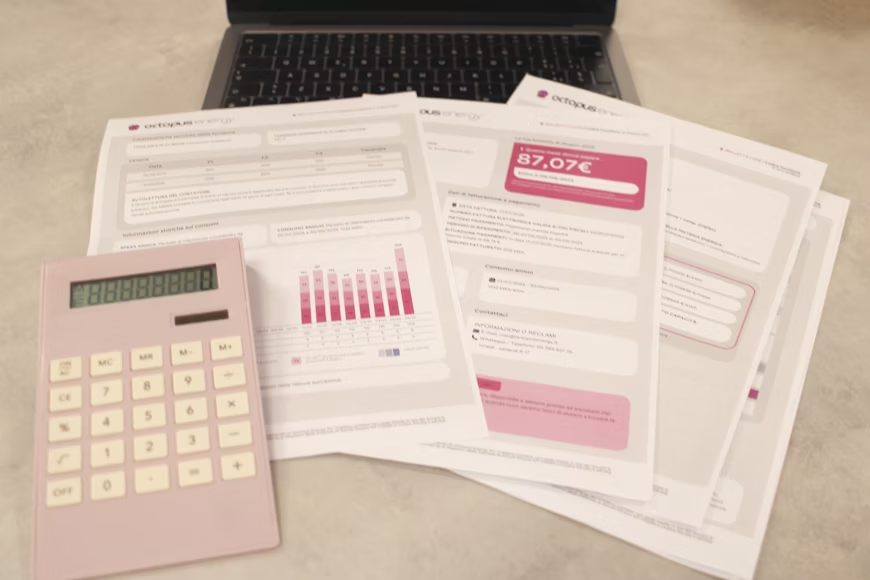

Financial Service, Bank, Insurance

How AI is Rewriting the Rules in Financial Services

Artificial Intelligence is becoming the heartbeat of modern finance. From fraud detection to customer service, risk modeling to algorithmic trading, AI is helping financial institutions enhance accuracy, efficiency, and personalization.

For banks and insurers, AI-powered chatbots and robo-advisors improve customer support and increase engagement without increasing headcount. Credit scoring models now factor in thousands of non-traditional variables, allowing for more inclusive and precise lending decisions.

In the back office, AI automates compliance checks, detects anomalies in real-time, and streamlines document processing. For investment firms, machine learning drives smarter portfolio decisions and market predictions, transforming how wealth is managed.

However, adopting AI isn’t just about tech, it's about trust, governance, and alignment. Institutions must balance innovation with responsibility. Explainable AI, fair data use, and human oversight are crucial to long-term success.

Semesta Consulting and Semesta Insight help financial service firms implement AI-driven solutions responsibly, backed by market research, regulation-aware strategies, and human-centered design.

Article written by

Rhesa Dwi Prabowo

Executive Director • Semesta Business

Read More Articles

Property, Real Estate, Education

The Future of Education: Blended, Personalized, and Lifelong

Written by Rhesa Dwi Prabowo

Financial Service, Bank, Insurance

The Future of Financial Services: Agile, Inclusive, and Ecosystem-Driven

Written by Rhesa Dwi Prabowo

Financial Service, Bank, Insurance

The Future of Banking: Platformization, Trust, and Hyper-Personalization

Written by Rhesa Dwi Prabowo

Financial Service, Bank, Insurance

The Future of Insurance: Hyper-Personalization, Prevention, and Embedded Models

Written by Rhesa Dwi Prabowo

Ready to Accelerate Your Growth with Confidence? Let's Start Now!

Back

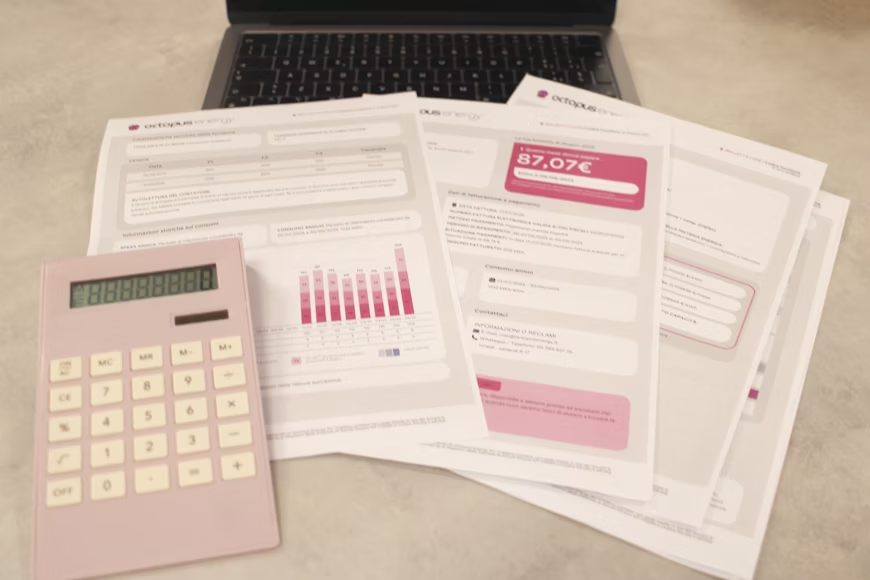

Financial Service, Bank, Insurance

How AI is Rewriting the Rules in Financial Services

Artificial Intelligence is becoming the heartbeat of modern finance. From fraud detection to customer service, risk modeling to algorithmic trading, AI is helping financial institutions enhance accuracy, efficiency, and personalization.

For banks and insurers, AI-powered chatbots and robo-advisors improve customer support and increase engagement without increasing headcount. Credit scoring models now factor in thousands of non-traditional variables, allowing for more inclusive and precise lending decisions.

In the back office, AI automates compliance checks, detects anomalies in real-time, and streamlines document processing. For investment firms, machine learning drives smarter portfolio decisions and market predictions, transforming how wealth is managed.

However, adopting AI isn’t just about tech, it's about trust, governance, and alignment. Institutions must balance innovation with responsibility. Explainable AI, fair data use, and human oversight are crucial to long-term success.

Semesta Consulting and Semesta Insight help financial service firms implement AI-driven solutions responsibly, backed by market research, regulation-aware strategies, and human-centered design.

Article written by

Rhesa Dwi Prabowo

Executive Director • Semesta Business

Read More Articles

Property, Real Estate, Education

The Future of Education: Blended, Personalized, and Lifelong

Written by Rhesa Dwi Prabowo

Financial Service, Bank, Insurance

The Future of Financial Services: Agile, Inclusive, and Ecosystem-Driven

Written by Rhesa Dwi Prabowo

Financial Service, Bank, Insurance

The Future of Banking: Platformization, Trust, and Hyper-Personalization

Written by Rhesa Dwi Prabowo

Financial Service, Bank, Insurance

The Future of Insurance: Hyper-Personalization, Prevention, and Embedded Models

Written by Rhesa Dwi Prabowo

Ready to Accelerate Your Growth with Confidence? Let's Start Now!

Solutions

Industry

Company

Email Us

Send a Message

Back

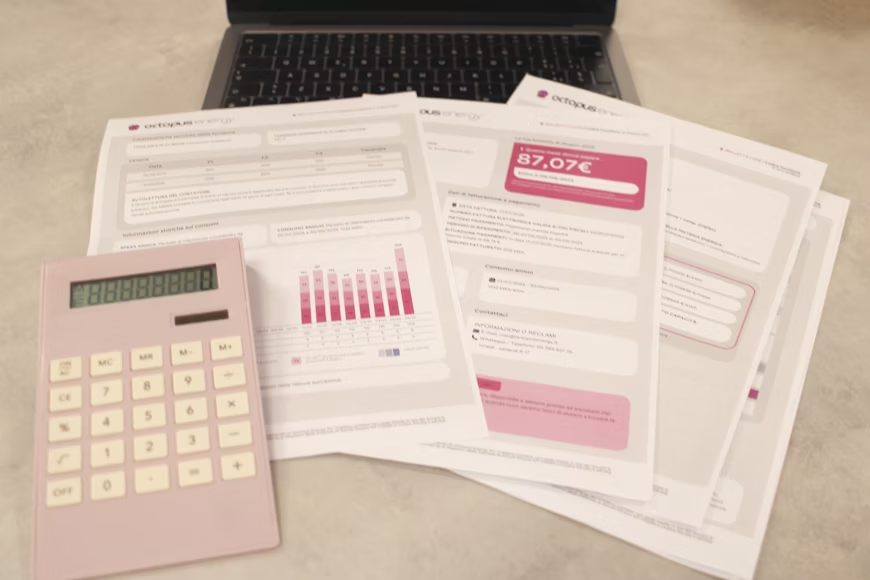

Financial Service, Bank, Insurance

How AI is Rewriting the Rules in Financial Services

Artificial Intelligence is becoming the heartbeat of modern finance. From fraud detection to customer service, risk modeling to algorithmic trading, AI is helping financial institutions enhance accuracy, efficiency, and personalization.

For banks and insurers, AI-powered chatbots and robo-advisors improve customer support and increase engagement without increasing headcount. Credit scoring models now factor in thousands of non-traditional variables, allowing for more inclusive and precise lending decisions.

In the back office, AI automates compliance checks, detects anomalies in real-time, and streamlines document processing. For investment firms, machine learning drives smarter portfolio decisions and market predictions, transforming how wealth is managed.

However, adopting AI isn’t just about tech, it's about trust, governance, and alignment. Institutions must balance innovation with responsibility. Explainable AI, fair data use, and human oversight are crucial to long-term success.

Semesta Consulting and Semesta Insight help financial service firms implement AI-driven solutions responsibly, backed by market research, regulation-aware strategies, and human-centered design.

Article written by

Rhesa Dwi Prabowo

Executive Director • Semesta Business

Read More Articles

Property, Real Estate, Education

The Future of Education: Blended, Personalized, and Lifelong

Written by Rhesa Dwi Prabowo

Financial Service, Bank, Insurance

The Future of Financial Services: Agile, Inclusive, and Ecosystem-Driven

Written by Rhesa Dwi Prabowo

Financial Service, Bank, Insurance

The Future of Banking: Platformization, Trust, and Hyper-Personalization

Written by Rhesa Dwi Prabowo

Financial Service, Bank, Insurance

The Future of Insurance: Hyper-Personalization, Prevention, and Embedded Models

Written by Rhesa Dwi Prabowo

Ready to Accelerate Your Growth with Confidence? Let's Start Now!